👋 Readers, this is 26 straight weeks of Weekly Notes!

I am continuing to refine the structure of Weekly Notes, but the general theme remains to share the news and issues I am tracking every week. The subject areas encompass economic and national security, finance and technology, as well as risk, regulation, and financial crime.

There continues to be a flood of geopolitical activities influencing markets and industries. Here in the US, the Trump Administration continues on the deregulatory agenda while also applying maximum pressure on real threats to US economic and national security interests. The balance between innovation, economic prosperity, and risk mitigation is an orchestration we have not historically seen before.

Interesting issues and news across the US economic and national security landscape.

Analysis: The White House and Treasury took significant actions over the past week aimed at dismantling Cartels, DTOs, and the fentanyl epidemic. Major shifts in economic sanctions policies concerning Syria and Cuba, and Trump awaits the OBBB after passing through the Senate. Another week of consistent actions and activities aimed at US economic and national security flexing.

Here are seven (7) links sourced directly from the White House and US Department of the Treasury.

Treasury Issues Historic Orders under Powerful New Authority to Counter Fentanyl

Treasury Sanctions Global Bulletproof Hosting Service Enabling Cybercriminals and Technology Theft

Fact Sheet: President Donald J. Trump Provides for the Revocation of Syria Sanctions

Fact Sheet: President Donald J. Trump Strengthens the Policy of the United States Toward Cuba

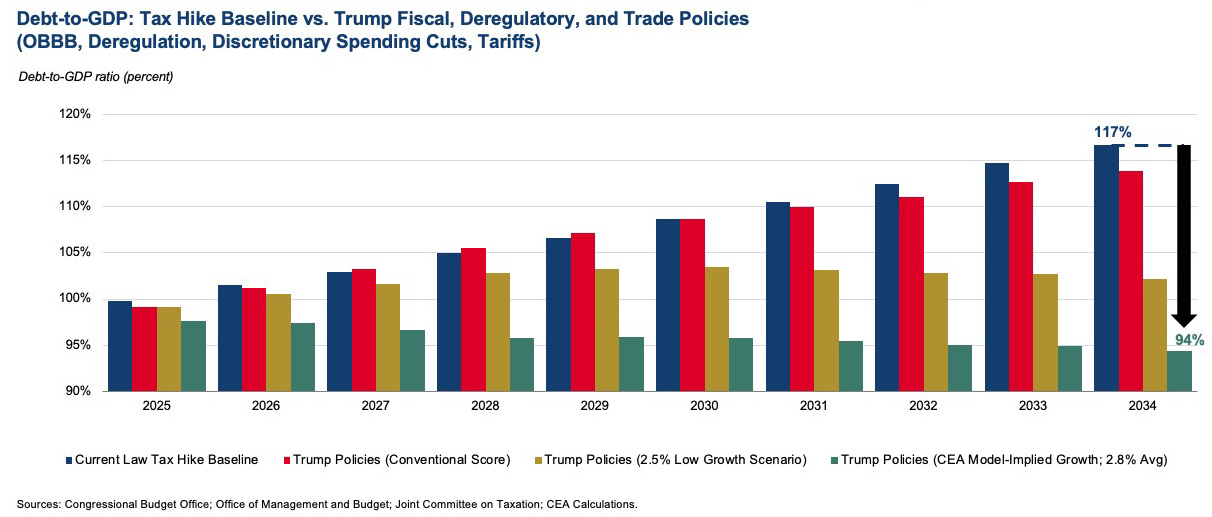

The One Big Beautiful Bill has passed in the Senate

The One Big Beautiful Bill Chart Book

Interesting issues and news across finance, technology, risk, regulation, and financial crime.

Analysis: The FBI made headlines with a takedown of 324 fraudsters in the largest DOJ health care case in history. The OCC keeps financial crime risks at an elevated level in its summer risk perspective. There was plenty of regulatory activity from international discussions, digital assets dialogue, more market movement by Circle, and modernization of that pesky (one of my favorite Jim Richards words) CIP rule.

Here are seven (7) links sourced directly from the DOJ, Treasury, Congressional committees, digital asset companies, and media.

Joint Statement on the EU-U.S. Joint Financial Regulatory Forum

OCC Report Highlights Key Risks in Federal Banking System

Scott Joins Lummis, Hines to Discuss Principles of Digital Asset Market Structure Legislation

Circle Applies for National Trust Charter

Polymarket nears Founders Fund-led funding at over $1 billion valuation, source says

Interesting reports.

2025 Federal Reserve Stress Test Results