👋 Readers, this is 27 straight weeks of Weekly Notes!

I’m on week 2 of an epic road trip (more to come on that), so this will be a light version of my weekly notes.

The One, Big, Beautiful Bill has been signed into law by President Trump, Middle East ceasefire negotiations continue, and the Russia-Ukraine war continues to get messier. Those are the macro highlights over the past week.

Interesting issues and news across the US economic and national security landscape.

Analysis: Trump continues with aggressive tariff policies and maneuvers, and Treasury continues to apply maximum pressure (via sanctions) targeting Iran and the DPRK. While it was a relatively slower week of activity across the security landscape, the Trump Administration continues to focus on an American-led reordering of global trade and security interests.

Here are four (4) links sourced directly from the White House and the US Department of the Treasury.

Treasury Targets Diverse Networks Facilitating Iranian Oil Trade

Treasury Sanctions Hizballah Financial Officials

Sanctions Imposed on DPRK IT Workers Generating Revenue for the Kim Regime

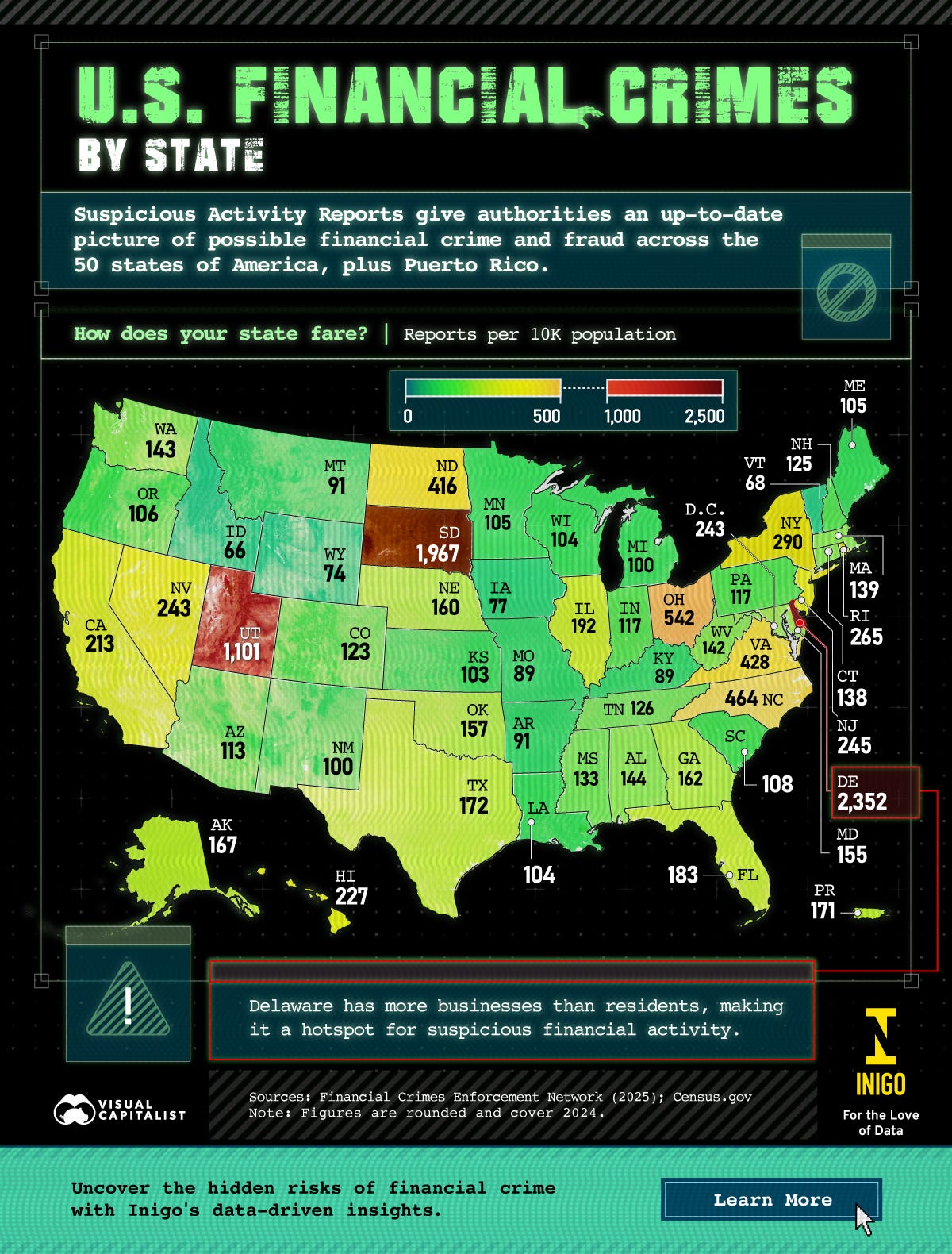

Interesting issues and news across finance, technology, risk, regulation, and financial crime.

Analysis: Innovation highways are open, and everyone wants to lean into the FinTech and digital assets space. However, Monzo got a friendly reminder from the FCA that financial crime controls are still one of the required pillars of innovating (fast). While $28M is a speeding ticket equivalent, enforcement actions continue globally across the financial services industry.

Here are three (3) links sourced directly from Congressional committees and the media.

House Announces Week of July 14th as “Crypto Week”

Monzo fined $28 million by UK regulator for inadequate financial crime controls

Interesting reports.

No one should be reading “interesting reports” during July or August, and certainly not from the FDIC, but just in case you care to peruse…

Consumer Compliance Supervisory Highlights from the FDIC