Weekly Notes, 043.

October 31, 2025

👋 Readers, this is 43 straight weeks of Weekly Notes!

Travel blog update: 🎃 trick or treating around the neighborhood!

This week’s headline: Trump and Xi meet in South Korea to ease tensions at the top of the world's great power competition. Trade and tariffs are the flashpoints for US economic and national security interests linked to rare earth minerals, agriculture, and the fentanyl crisis.

Secretary Bessent on the meeting.

Below, you’ll find links to information that I’ve been consuming since last week and using to get smarter on issues of interest.

I hope these weekly notes are useful, and I appreciate any feedback you have.

Interesting issues and news across the US economic and national security landscape.

Analysis:

American leadership was on display in Asia this past week — trade, peace, and critical minerals. Trump and Xi (as highlighted above), South Korea, Japan, and Malaysia, in what any objective person would call a productive work week. The White House has fact sheets out, and these are great resources to understand deal frameworks. While the economic discussions progress, Trump made a historic move to restart nuclear testing as the great power competition remains a thing (Russia has a lot of nuclear weapons). Also, Treasury designating a foreign head of state speaks volumes on the Administration's seriousness (aside from the continued kinetic actions we see out in the Caribbean) regarding the disruption of illicit drug production, trafficking, and the direct threat to US national security.

Eight (8) links below to sourced information from the past week.

Trump cuts fentanyl tariffs on China to 10% as Beijing delays latest rare earth curbs by a year

Treasury Sanctions Colombian President Gustavo Petro and His Support Network

Homeland Security Task Forces Target Transnational Organized Crime on U.S. Soil

Fact Sheet: President Donald J. Trump Drives Forward Billions in Investments from Japan

Fact Sheet: President Donald J. Trump Secures Peace and Prosperity in Malaysia

Trump orders nuclear testing to resume after 33 years

Interesting issues and news across finance, technology, risk, regulation, and financial crime.

Analysis:

A light week on the financial crime front, but in the resources section, a client letter from WH is about the most forward-looking (and accurate) account of the recent FinCEN SAR guidance (FAQs), worth the read. There was some action coming out of the Fed with another rate cut and projected cuts to bank oversight staff as well. Statements and remarks coming from the Fed (or other bank regulators) are always great for dissecting and signals to get ahead of policy shifts, focus, etc. A couple of other industry-related news items, but relatively quiet across finance (I think everyone must have been partying at Money20/20).

Seven (7) links below to sourced information from the past week.

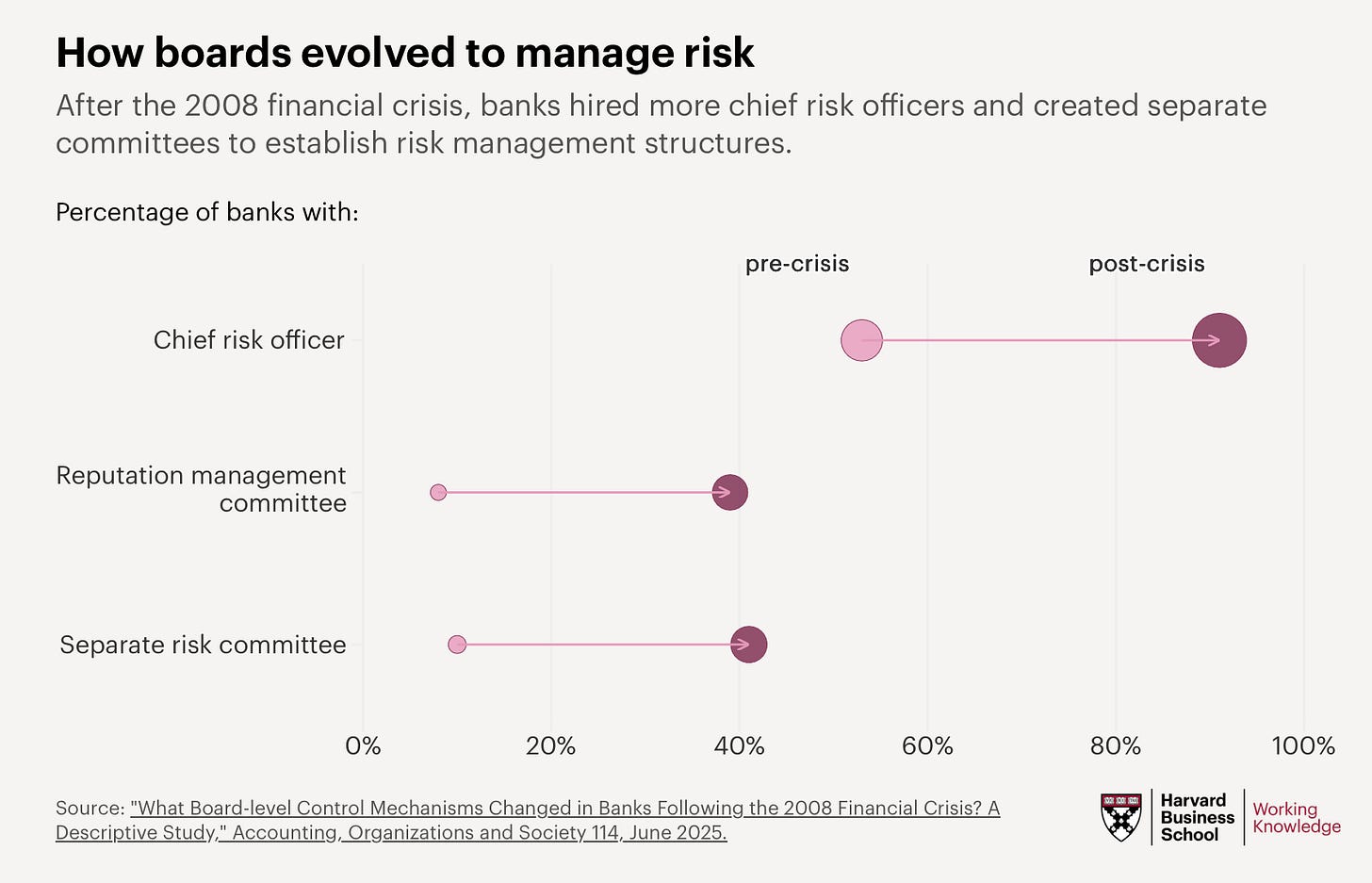

How Banks Tightened Risk Controls After the 2008 Crisis

Federal Reserve issues FOMC statement

Huntington Bancshares Incorporated to Acquire Cadence Bank

Powell says AI boom not a bubble, unlike dot-com era

Fed to cut bank oversight staff by 30% by 2026

JPMorgan launches blockchain tool for private funds

Interesting reports and resources.

AI at work: getting more done with less hype from Perplexity

Client Alert from Wilmer Hale on FinCEN SAR Requirements